ne beautiful feature of Solid Wealth Strategy is that it is very flexible in terms of level of activity. By activity, we mean trades, i.e. buys or sells that get executed in the market. Therefore, level of activity refers to how often we buy or sell when we apply Solid Wealth Strategy. Level of activity is also called “frequency of activity”.

Frequency of activity can range anywhere between the following two extremes:

- Extremely infrequent, i.e. trades occur once every few months or even years

- Extremely frequent, i.e. trades occur once every second or even millisecond

For infrequent trades, manual order handling is perfectly adequate. On the other hand, frequent activity may necessitate automated systems. Obviously, anything that is more frequent than once every few minutes or so, has to be automated.

Good news is that we have the ability to achieve desired level of activity. Normally, we take that into account during the design stage of the Strategy. We often shoot to get trades every day or couple of days which may be considered as a golden middle. However, things are not always black and white. Thus, it is desirable to understand the process so we can make trade-offs and informed decisions along the way.

After all, how often we trade depends on our individual preferences. We seek the right compromise that fits our investing temperament and appetite for profitability.

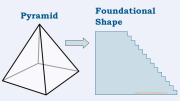

ll things equal, we tend to trade as little, or infrequent, as possible – that is easier and it doesn’t require automation. However, there is one very strong reason to increase the level of activity: profitability. In general: The more active we are, the more profitable we get (with under-capitalization as an exception to this rule).

Thus, when properly capitalized, one can increase profitability with design that intensifies the activity or reduces the expected time between trades. The logical reason for higher profitability is that the higher level of activity captures more oscillations and extracts more profits from volatility. The flip side is that more trades means more money spent on commissions. That is one of the reasons why higher level of activity is more efficient when applied to better capitalized accounts.

Please note that the frequency of activity we talk about here is expected or average frequency of activity. Normally, there is no regularity in time that passes between two actions. Since Strategy is based on responding to prices in the market and market does whatever the market does, specific trades are generally out of our control and they do not occur on a regular time schedule in any case.

herefore, it is up to you to decide what level of activity best suits you. Every investor needs to find their own sweet spot where:

- Frequency of activity is low enough and

- Level of profitability is satisfyingly high

Obviously, extra time spent tending orders is rewarded with higher profitability. In case of automated systems, extra time is spent operating and monitoring the system itself. When primary goal is to maximize the profitability, the only real limitation is the amount of capital under disposal. Capital determines the ballpark of investor’s level of activity.

In simple terms, those who are afraid that the strategy would require too much of their time should know that that is not true if they don’t have too big of an appetite for profits.

On the other hand, those who desire higher profitability can achieve that primarily by increasing their level of capital commitments but also, to a limited degree, by appropriate design that increases their level of activity.

Again, the strategy is flexible enough to accommodate wide range of investors’ capitalizations and time constraints. You just need to dial in your numbers and your investing temperament.

Tweetable: