ince you’ve arrived to the application stage, the expectation is that you’ve probably spent enough time on previous stages – you are already familiar with foundations of the strategy and you’ve completed planning and design stages. Before you start applying the strategy within your investing account and with the real capital, it is a good idea to recap a few things and go through a check-list to confirm you have everything in place for a successful start.

Basically, go through the following list of items and make sure you can check them off:

- 1. Plan the amount of available capital

- 2. Have funds settled at the brokerage account

- 3. Get familiar with brokerage commissions and entering orders

- 4. Research investing vehicle(s) or instrument(s)

- 5. Design strategy solid(s) (top, base, step, cost etc)

- 6. Confirm profitability considering commissions

- 7. Choose your favorite option for positions entry

There is no real investing without real capital. If you don’t have real capital or if you don’t have enough, you can still perform so called “paper investing”. Traders often do paper trading since they need to prove their concept or idea before they commit real capital to it. They also need to acquire certain skills that their profitability depends on.

Neither of these two reasons is needed in case of Solid Wealth Strategy. The strategy can easily be proven viable and profitable (see bullet #6). Also, most if not all the skills traders need are not necessary for our strategy. You can perform paper investing in situations where you lack investing capital and you have a need to satisfy your curiosity as to how you would have performed had you invested real money. Otherwise, paper investing in case of Solid Wealth Strategy is a waste of time.

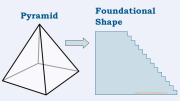

2When you do have investing capital, it needs to be transferred and settled at your brokerage account. Even though strategy can successfully be performed on real assets outside brokerage accounts, we will not consider those advanced applications at this time. Preferably, you want to have enough capital at brokerage account to cover the whole cost of your pyramid or skyscraper before you start applying them.

3Besides having your funds at the brokerage account, we assume you have already familiarized yourself with features of that account. At the minimum, you need to know your brokerage commissions and how to enter orders. Great thing about Solid Wealth Strategy is that you don’t really need to know much more than that. You can skip scores of technical indicators and similar stuff that most brokerage houses want you to focus on. We deal with simple stuff.

4As a part of planning stage, you should have researched investing instruments that you plan on using in your strategy. You probably know the company names, ticker symbols, their sectors and perhaps some fundamental information. You can never know too much, but if you don’t – that’s OK. Just make sure you know specifics required by the strategy. Everything else is optional.

5Of course, by now you have developed your strategy’s blueprint – you have gone through the process of designing your solids and you’ve determined the shape you are going to use. Just make sure you are aware of the top of your shape and current market price of your instrument. The total cost of your solid needs to be appropriate for the amount of capital you have at your account.

6You need to have chosen your base and step carefully in order to be profitable when you deduct trading commissions imposed by your broker. Profitability of the strategy is easy to verify: just make sure your basic oscillation is profitable and the whole investing process will be profitable too. Solid Wealth Strategy does not depend on statistics of profits and losses – we exclusively book profits! It’s a one way road to success from here!

7Depending on the top level of your designed solid, you may have several options to enter the positions for the first time. You can pick one based on your temperament or preference. You can’t really go wrong here. We talk more about entering positions in articles within this category.

This concludes pre-application check-list. If you can tick all of the items above, you can start applying your strategy right away. It is important to start being active as soon as you can. You don’t need to achieve perfection. Application stage is the repetitive one and you will have plenty of opportunities to improve your approach and advance in your skills. Just get yourself in the market and be a market maker!